Order • Mastery • Stewardship • Stability.

Every man wants financial freedom.

But not every man wants the discipline required to achieve it.

The truth is simple but uncomfortable:

Wealth is not created by big moments — it’s created by daily discipline.

Not by hype.

Not by luck.

Not by shortcuts.

Real wealth comes from a man who has structure, consistency, focus, and respect for his money.

A man who understands that God blesses order, not chaos.

A man who knows that the same discipline he uses to improve his body, his faith, and his identity is the same discipline he must use with his finances.

Here’s how to build the kind of discipline that produces real wealth — not just income, but legacy.

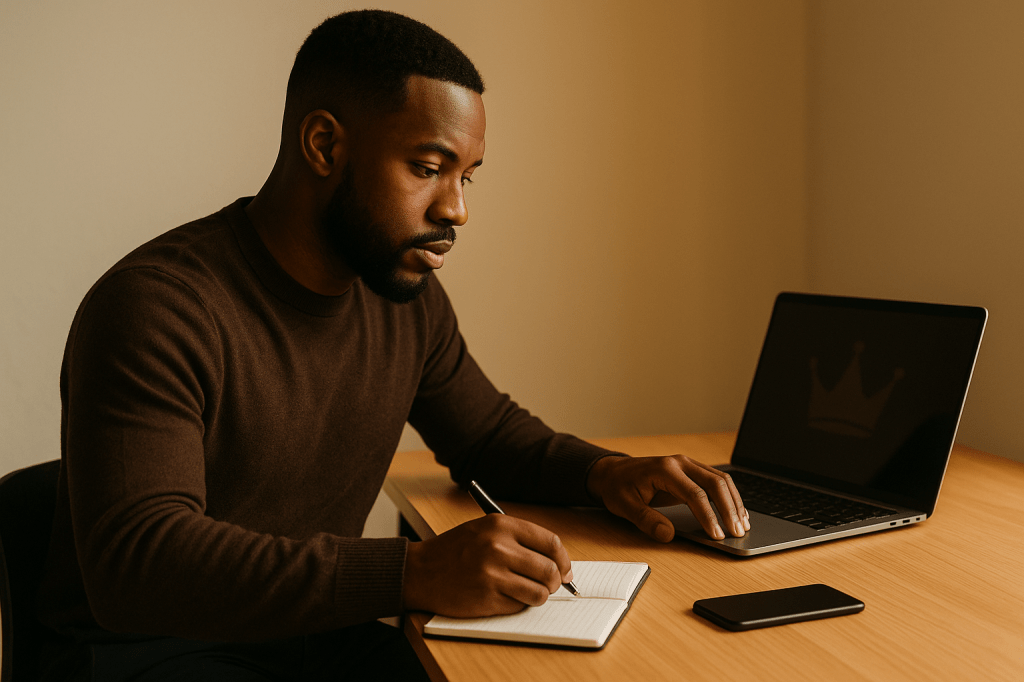

Track Every Dollar — A King Knows the Condition of His Kingdom

Money respects attention.

If you don’t track it, it will control you.

Tracking your spending forces you to:

- face your habits

- see your waste

- catch emotional spending

- understand your patterns

- correct mistakes sooner

You don’t need complicated systems.

You need:

- a notes app

- a simple budget

- a clear view of income vs. expenses

A disciplined man doesn’t fear numbers — he commands them.

Spend Less Than You Earn — Mastery Before Luxury

You can’t build wealth if you’re living at your limit.

Your spending must be slightly below your lifestyle so money can compound, flow, and grow.

Wealthy men don’t look rich first.

They become rich first.

Then they look the part.

Your clothes, your car, your restaurants — none of it matters if it breaks your financial backbone.

Discipline now creates options later.

Build a $1,000 Emergency Fund (Minimum)

This isn’t optional.

It’s protection.

An emergency fund keeps you from:

- using credit cards for crises

- falling behind when life happens

- losing progress when income dips

- spiraling when unexpected expenses pop up

It’s not about fear.

It’s about freedom.

You become unshakeable financially when you know you can handle surprises.

Attack Debt Strategically — Not Emotionally

Debt isn’t just financial weight — it’s mental clutter.

A disciplined man removes the clutter quickly so his mind stays sharp.

Use one of two approaches:

Debt Snowball:

Pay off the smallest debt first → builds momentum and confidence.

Debt Avalanche:

Pay the highest interest first → saves the most money.

Pick one and stick to it relentlessly.

A man with no consumer debt is a man with options.

Build Credit the Intelligent Way

Good credit is not about “being responsible.”

It’s about leverage.

When you have strong credit:

- interest rates drop

- lenders trust you

- home ownership becomes easier

- business loans unlock

- opportunities multiply

You become financially dangerous — in a good way.

Disciplined credit habits = future wealth leverage.

Automate Discipline — Because Discipline Shouldn’t Be Exhausting

The smartest men automate:

- savings

- bill payments

- investment deposits

- recurring tithes or charitable giving

- credit card payments

Automation protects you from your worst impulses.

It makes discipline easy by removing human error.

A structured man is a wealthy man.

Invest Consistently, Not Emotionally

Real wealth is not built by trying to “get rich quickly.”

It’s built by:

- consistency

- time

- patience

- compound interest

Even $50 or $100 monthly invested properly grows.

Masculine discipline is not about speed — it’s about direction.

Avoid Lifestyle Inflation — Stay Hungry While You Grow

As your income increases, your spending should not automatically rise with it.

Lifestyle inflation is the silent killer of masculine financial potential.

Your goal is simple:

Increase income.

Keep expenses stable.

Let the gap grow.

Invest the difference.

This is how men become financially free long before everyone else.

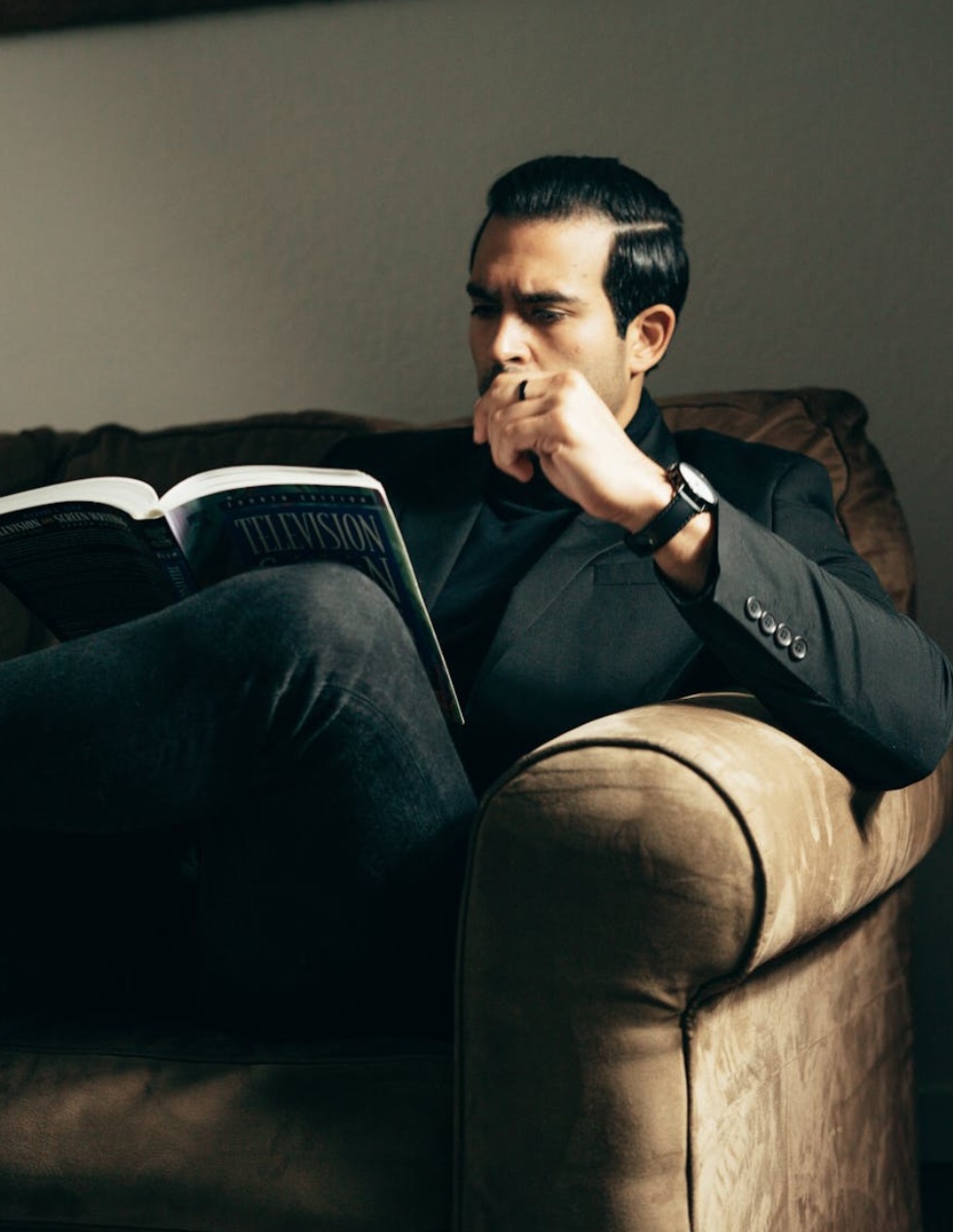

Think Legacy — Not Just Comfort

You’re not just managing money.

You’re managing:

- your future

- your last name

- your family’s advantage

- your long-term stability

- your God-given opportunities

Real wealth isn’t measured by what you have today —

It’s measured by what will still exist after you’re gone.

That’s legacy.

That’s discipline.

That’s manhood.

Final Word

Financial discipline isn’t restrictive — it’s empowering.

It gives you freedom.

It gives you clarity.

It gives you options.

It gives you authority.

And most importantly, it honors the God who put breath, ability, and opportunity inside you.

A man who masters his money masters his life.

Start today — future you is depending on it.

Blessings & Strength,

Corwin L Guilliams

Founder, CLG Lifestyle

CLG Lifestyle — A Kingdom-driven men’s lifestyle movement dedicated to elevating modern Davidic men through Faith, Fashion, Fitness, Food, Forgiveness, Current Events, Community Development and More…

We equip Kingdom men to live boldly, walk in purpose, embrace identity, and rise as the kings God designed them to be.

Where Kingdom Identity Becomes Kingdom Reality.

Follow the Movement:

- Website: https://clglifestyle.com/

- Instagram: https://www.instagram.com/clglifestyle/

- YouTube: https://www.youtube.com/@clglifestyle/

- Facebook: https://www.facebook.com/CLGLifestyle/

Leave a comment